26+ Credit score for home loan

Lenders use borrowers FICO scores along with other details on borrowers credit reports to assess credit. An FTC study found that 26 of participants had.

Loan Contract Modification Request 26 Great Loan Agreement Template Loan Agreement Template Is Needed As References On What To D Loan Agreement Best Loans

In Australia a home loan typically has a 25-year or 30-year loan term is repaid via regular payments and accrues interest.

. The social credit initiative calls for the establishment of a record system so that businesses individuals and government institutions can be tracked and evaluated for trustworthiness. The loan is secured on the borrowers property through a process. 6 to 30 characters long.

The higher your credit score is the better your chances are to be approved for a loan with better rates. The minimum credit score is 580 for borrowers with a maximum 9775 LTV ratio. But the amount of time it takes is not the same across the board.

Taking out a personal loan can affect your credit score in a number of waysboth good and bad. Prime 660 - 719 468. The credit score needed for a home improvement loan depends on the loan type.

ASCII characters only characters found on a standard US keyboard. Earn unlimited 2 cash rewards on purchases. There could be a temporary drop in your credit score if you enroll in a debt consolidation program but as long as you make on-time payments your score quickly improves and you are eliminating the debt that got you in trouble to start.

VA home loans dont have a minimum credit score requirement so its possible to get this type of loan with a 600 credit score. The lowest APR you can find on a credit card is around 10 a rate that will only be available to those stellar credit. How To Get a Home Equity Loan.

The information contained in Ask Experian is for educational purposes only and is not legal advice. Find out the average auto loan rates by credit score how auto loan rates work and where you can get the best auto loan rates. Your credit score is based on many factors including your payme.

Older Posts Home. A good credit score generally starts at 700 and a score of 800 or above is considered excellent. The minimum credit score is 500 for borrowers with a maximum 90 LTV ratio.

With an FHA 203k rehab loan you likely need a 620 credit score or higher. The average mortgage interest rate is around 55 for a 30-year fixed mortgage. Average New and Used Car Loan Rates by Credit Score.

0 intro APR for 15 months from account opening on purchases. Balance Transfer Intro APR. Earn a 200 cash rewards bonus after spending 1000 in purchases in the first 3 months.

Posts Atom NigerianEye Newsletter. Interest is what a lender charges to let you borrow money written as a percentage. It usually takes a very good credit score to qualify for one of these.

Your LTV ratio determines the minimum credit score required for a rate-and-term refinance on a mortgage backed by the Federal Housing Administration. Credit scores can range between 300 and 850. One of the most well-known credit scores is the FICO Scores.

A FICO score is a type of credit score created by the Fair Isaac Corporation. Mortgage Payoff Calculator Home Equity Loan Calculator. 2611 Youll only see this interest rate if you fail to make your minimum payments.

The Social Credit System Chinese. Repaying it in a timely manner is key to a healthy score. How To Get a Home Improvement Loan.

Cash-out refinancing typically requires. A home loan or mortgage is a loan from a bank or other financial institution to buy build refinance or renovate a residential property. If you have an excellent credit score and a high income though you are more likely to.

Rates are influenced by the economy your credit score and loan type. Debt Consolidation Loans. How Can I Get My Credit Ready to Apply for a Home Loan.

Lenders set their own minimums which typically. Minimum credit score needed. For instance FICO requires a borrower to have at least one account open and it must have been reported to the major credit bureaus within the last six months in.

Here are the average new and used car loan rates by credit score according to Experians Q2 2021 State of the Automotive Finance Market report. Your lender or insurer may use a different FICO Score than FICO Score 8 or another type of credit score altogether. As a result when you get your first credit card or personal loan it takes some time to generate your first score.

Prospective borrowers must have a minimum personal credit score of 600 to qualify for an OnDeck term loan or line of creditAdditionally their business must have been in operation. Using the same FICO loan savings calculator in the example above heres how much the calculator estimated youd spend on interest in total based on credit score. Most average between 12 to 26.

Most lenders require a combined loan-to-value ratio CLTV of 85 percent or less a credit score of 620 or higher and a debt-to-income DTI ratio below 43 percent to approve you for a home equity. You should consult your own. A good FICO Score starts at 670.

How Credit Scores for Mortgage Borrowers Differ. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Shèhuì xìnyòng tǐxì is a national credit rating and blacklist being developed by the government of the Peoples Republic of China.

Must contain at least 4 different symbols. VA home loan. Credit score calculated based on FICO Score 8 model.

Equifax was charging 1595 for a report and a score at that time and TransUnion was offering unlimited score and report access plus credit monitoring for 2495 per month. 0 for 1291 months Usually 0 and sometimes offered for the same length of time as the purchase intro APR this promo rate applies to balances transferred from another credit card or loan. 760-850 score 84000.

Consider a Debt Consolidation Plan. How To Get a Car Loan. Experian offered a free FICO score and credit report in June 2020 as well as a free credit report if you created an account with the company.

Super prime 720 or above 365.

26 Great Loan Agreement Template Contract Template Loan Best Loans

26 Promissory Note Templates Google Docs Ms Word Apple Pages Free Premium Templates

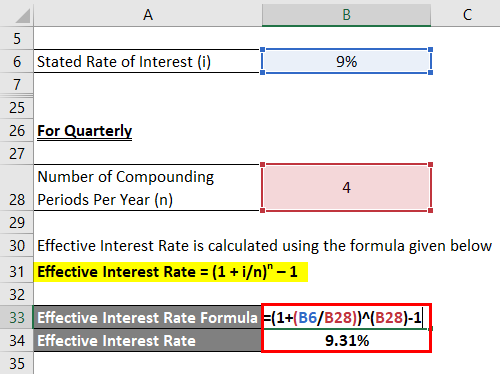

Effective Interest Rate Formula Calculator With Excel Template

Smartsheet Free Google Docs Budget Templates Smartsheet 2a253e36 Resumesample Resumefor Budget Template Budget Spreadsheet Template Budget Template Free

Personal Loan Contract Template Awesome 40 Free Loan Agreement Templates Word Pdf Template Lab Contract Template Business Rules Personal Loans

Lease Renewal Agreement Check More At Https Nationalgriefawarenessday Com 17891 Lease Renewal Agreement

26 Promissory Note Templates In Word Google Docs Pages Free Premium Templates

Terms Of Agreement Sample Inspirational 22 Examples Of Employment Contract Templates Word Contract Template Contract Agreement Employment

2

26 Loans Wordpress Themes 2022 S Best Wp Templates For Home Loan Private Money Lender

Maturity Value Formula Calculator Excel Template

Apology Letter Sample Business Letter Template Letter Templates Free Letter Sample

In House Financing Complete Guide On In House Financing

Lending Money Contract Template Free Fresh Loan Agreement Letter Loan Contract And Agreement Contract Template Loan Lettering

26 Great Loan Agreement Template Contract Template Loan Money Private Loans

Types Of Letter Of Credit Lc Types Of Lettering Lettering Equity

Weekly Work Schedule Template In Excel Format Schedule Template Monthly Schedule Template Schedule Templates